Enhanced Indexing

Here’s a quote from Mr. Buffett in his annual letter to Berkshire shareholders in 2014 about his will: “My advice to the trustee couldn’t be simpler: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500® index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions or individuals…” – Z-alpha coincides only in part with Mr. Buffett as investors can add tremendous value by relinquishing the 10% bond allocation and directly assigning those funds to an active bona fide hedged equity set of tactics.

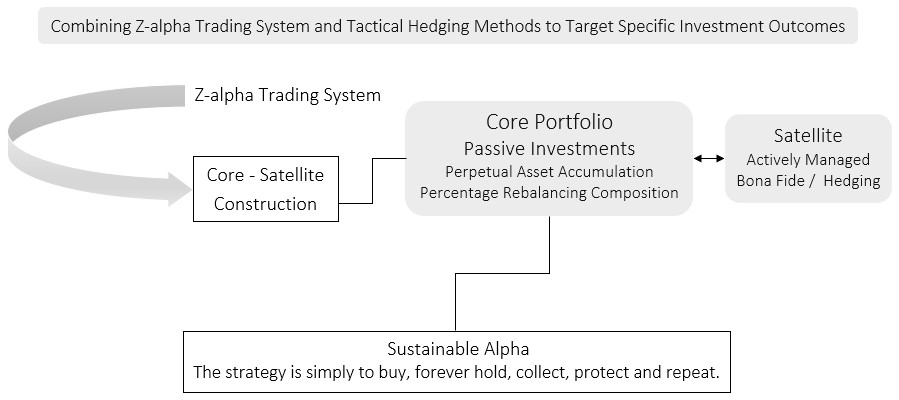

Implementation: Distribute 90% of the allocated assets into the core portfolio account for the acquisition of the specified ETF. This foundational constituent of the investment portfolio should never get sold. All additional ETF purchases (from hedging profits, reinvested dividends, etc.) will transpire when the core-satellite ratio needs occasional realignment. As delineated above and worth repeating, the strategy is to buy, forever hold, collect, protect, and repeat. On the condition that one follows this pattern for years, along with the added compounding generator of continual ETF accumulation from the hedging excess can produce favorable results.

*Index futures are a popular trading instrument for safeguarding portfolios, and this methodology draws on futures for hedged equity profiles.